For countless aspiring minds across the United Kingdom, the journey to higher education is a beacon of hope, promising intellectual growth and future opportunities. Yet, this noble pursuit often comes tethered to significant financial considerations. Enter the maintenance loan – a vital lifeline designed to cover living costs, rent, and daily expenses, allowing students to immerse themselves fully in their studies without the constant shadow of financial strain. But for many, the burning question remains: When exactly does this indispensable financial support arrive, and how can students effectively plan around its disbursement?

Understanding the intricate rhythm of maintenance loan payments is not merely a logistical detail; it’s a cornerstone of successful student budgeting and peace of mind. These funds, typically administered by the Student Loans Company (SLC) for English students and their devolved counterparts across the UK, are meticulously scheduled to align with academic terms. This structured approach ensures a steady flow of support, preventing a single, overwhelming lump sum and instead providing consistent assistance throughout the academic year. By strategically anticipating these crucial dates, students can transform potential financial anxieties into proactive planning, truly mastering their monetary landscape.

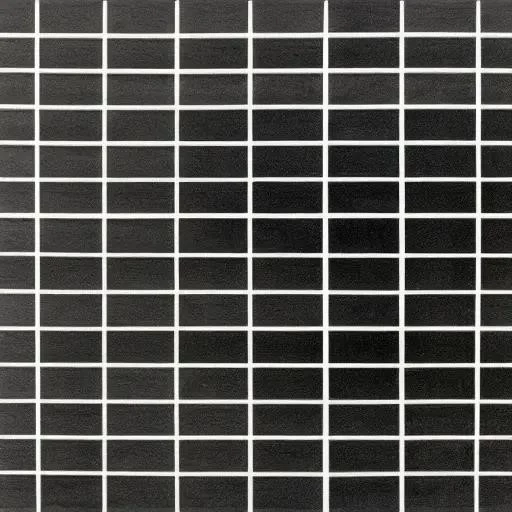

| Aspect of Maintenance Loan Payment | Description & Key Information |

|---|---|

| Standard Payment Schedule | Maintenance loans are typically disbursed in three equal instalments per academic year. These payments are usually made at the start of each university term (Autumn, Spring, Summer). |

| Disbursement Trigger | Funds are released only after your university or college confirms your attendance to the Student Loans Company (SLC) or relevant regional body (e.g., Student Awards Agency Scotland ⎯ SAAS, Student Finance Wales ‒ SFW, Student Finance Northern Ireland ⎯ SFNI). This usually happens a few days after term officially begins; |

| Application & Bank Details | Ensure your application is fully completed and approved well in advance of your course start date. Correct and up-to-date bank details are absolutely critical for timely payments. Any discrepancies can cause significant delays. |

| First Payment Timing | The first instalment is often the most eagerly anticipated. It usually arrives a few working days after your course start date, once your attendance has been successfully confirmed. Be prepared for a slight initial wait. |

| Regional Variations | While the three-instalment model is common across the UK (England, Scotland, Wales, Northern Ireland), specific dates, application processes, and administrative bodies may vary. Always check with your local student finance body for precise details; |

| Official Reference | For the most detailed and personalized information, always refer to the official government student finance portal for your region: Student Finance (gov.uk) |

These scheduled disbursements, often likened to the dependable tides that nourish coastal ecosystems, play an incredibly pivotal role in a student’s financial ecosystem. The first instalment, arguably the most eagerly awaited, typically arrives within days of the academic year commencing, provided all administrative hurdles have been smoothly navigated. This initial influx of funds helps students settle into new accommodations, purchase essential textbooks, and manage the inevitable setup costs associated with university life. Subsequent payments then punctuate the academic calendar, providing a reliable rhythm that underpins financial stability through the often-challenging mid-terms and exam periods.

However, this seemingly straightforward process can occasionally encounter unexpected ripples. A common pitfall for many students involves delays stemming from incomplete applications or incorrect bank details. The Student Loans Company, a veritable backbone of student support, meticulously processes thousands of applications annually, and any missing piece of information can cause a frustrating hold-up. “Proactivity is paramount,” advises Dr. Eleanor Vance, a leading expert in student welfare and financial literacy. “Submitting your application well ahead of the deadline, double-checking every detail, and ensuring your university has confirmed your attendance are incredibly effective strategies to guarantee timely payments.” Her insights powerfully underscore the empowering impact of preparedness.

Beyond the practical mechanics of payment dates, the maintenance loan embodies a far grander vision: democratizing access to education. It is an investment, not just in individual futures, but in the collective intellectual capital of the nation. By alleviating the immediate financial pressures, this vital support empowers students from diverse backgrounds to pursue their academic passions, fostering innovation and critical thinking that will ultimately shape our society; Looking forward, the systems supporting student finance are continually refined, adapting to evolving economic landscapes and student needs, promising an even more responsive and robust framework for generations to come.