Simple swing ideas on charts

First look at price swings

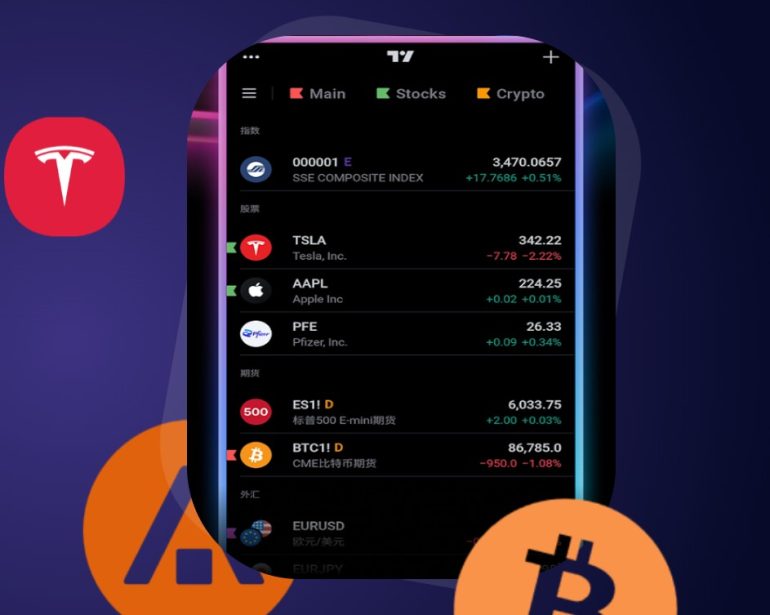

Swing trading lives between scalping and long‑term investing, focusing on price moves that unfold over several days or weeks. Instead of staring at every tick, a trader observes broader waves on the chart and searches for clear, repeatable patterns. In the middle of this routine a flexible platform such as TradingView helps combine indicators, drawings and alerts into one workspace that does not feel overloaded. A calm, structured screen leaves room for decisions, not chaos, so the whole process becomes more methodical and less emotional.

Shortlist a few liquid instruments first, then study their swings on higher timeframes before touching lower intervals.

Many beginners rush into strategies without a clear watchlist or rules, which quickly breaks discipline and hides the real performance of any approach. A defined set of instruments, a basic trade plan and a small group of trusted filters reduce impulsive entries. This structure also makes it easier to review trades later and understand whether results come from skill, luck or pure randomness. When that feedback loop works, the trader can refine setups instead of constantly jumping to the next shiny idea.

Moving averages as a map

Trend direction and context

One of the most practical tools for swing setups is the moving average, especially combinations like a short and a medium curve on the same chart. When price holds above both lines and pullbacks respect them, the bias stays bullish, while closes below and repeated failures to regain the curves point to a softer, declining phase. On a charting platform that supports custom layouts, this pair of averages can form the backbone of the screen, acting as a visual filter that keeps trades aligned with the broader move.

To keep decisions consistent, many traders use a short checklist and revisit it before every order. This habit reduces the temptation to chase random moves and prevents the chart from being overloaded with dozens of conflicting signals. Over time, the list can be adjusted as statistics reveal which rules help and which rules only create noise.

- Trade only in the direction of the main moving average slope.

- Look for entries after a pullback to the average, not in the middle of a sharp impulse.

- Cut losses when price clearly settles on the opposite side of both averages.

Two moving averages and clean price action often provide more clarity than a complex combination of rare indicators.

Momentum tools for confirmation

RSI and MACD for swings

Momentum indicators such as RSI and MACD help separate a healthy pullback from an early trend reversal. When price retreats to support and RSI stays above the neutral zone, a long setup looks more attractive than when the line collapses into deep weakness. MACD, with its lines and histogram, adds another layer by showing how quickly the current leg is gaining or losing strength, which matters a lot in swing trading.

On TradingView these indicators are added with a single click, and templates make it easy to save different combinations for distinct trading styles. This flexibility allows a trader to switch between assets while keeping a familiar screen structure, which is especially useful when monitoring several markets at the same time. A stable layout reduces cognitive load and helps the eye focus on signals instead of layout changes.

Support, volatility and exits

Levels, bands and range

Support and resistance levels remain classic tools for planning entries, targets and protective stops in any swing strategy. Volatility bands and similar indicators show how far price usually travels during a swing, which helps avoid unrealistic profit goals. When range information is combined with clear horizontal levels, a trader gains a simple but solid framework for building trade scenarios.

In many cases a stop is placed just beyond a key level, while the initial target is set at least twice as far from the entry as the stop. This reward‑to‑risk structure lets a trader stay profitable even with a modest win rate, as long as weak signals are filtered out. A consistent approach to exits also makes it easier to review trades later and fine‑tune the distance of stops and targets.

Routine, alerts and discipline

The final step is turning a set of ideas into a repeatable routine instead of a string of isolated lucky trades. The alert system inside TradingView helps with this by triggering notifications when price touches a level or an indicator crosses a threshold, so there is no need to stare at the screen all day. Trade journaling and regular strategy reviews transform raw results into lessons and give every signal a clear place in the bigger plan.

With time, a trader can arrive at a calm, structured process: well defined entry conditions, clear exit zones and a small group of indicators tuned to personal risk tolerance. In that context TradingView becomes more than a chart window; it turns into a control panel where every element supports analysis, execution and risk management from the first scan to the last closed position.